The announcement in 2016 of the extension of the ECB’s Asset Purchases Programme (APP) to include investment-grade euro-denominated bonds issued by non-bank corporations established in the euro area was to have significant implications for European corporate bond markets, both primary and secondary, impacting investors, dealers, and issuers.

The Corporate Sector Purchase Programme (CSPP) ended in December 2018, with the ECB maintaining holdings of a book value close to €180bn. In September 2019, the ECB announced that it would be restarting its APP from November 2019, including the resumption of the CSPP.

In March 2020, in response to the COVID-19 pandemic, the ECB announced further temporary measures, including additional bond purchases, as well as the Pandemic Emergency Purchase Programme, targeting up to an additional €750bn of public and private bond purchases. In June 2020 the ECB announced that it would extend the PEPP by €600bn to a total of €1.35tn up to the end of 2021. Then in December 2020 the ECB announced that it would be further extend the size of the PEPP by €500bn to a total of €1.85tn, with purchases extended to at least March 2022.

At its meeting on 16 December 2021, the ECB confirmed that it would discontinue purchases under the PEPP at the end of March 2022, with maturing principal payments being reinvested until at least the end of 2024. The APP, including the CSPP, ceased net purchases at the end of June 2022, with only the reinvestment of redemptions from July 2022.

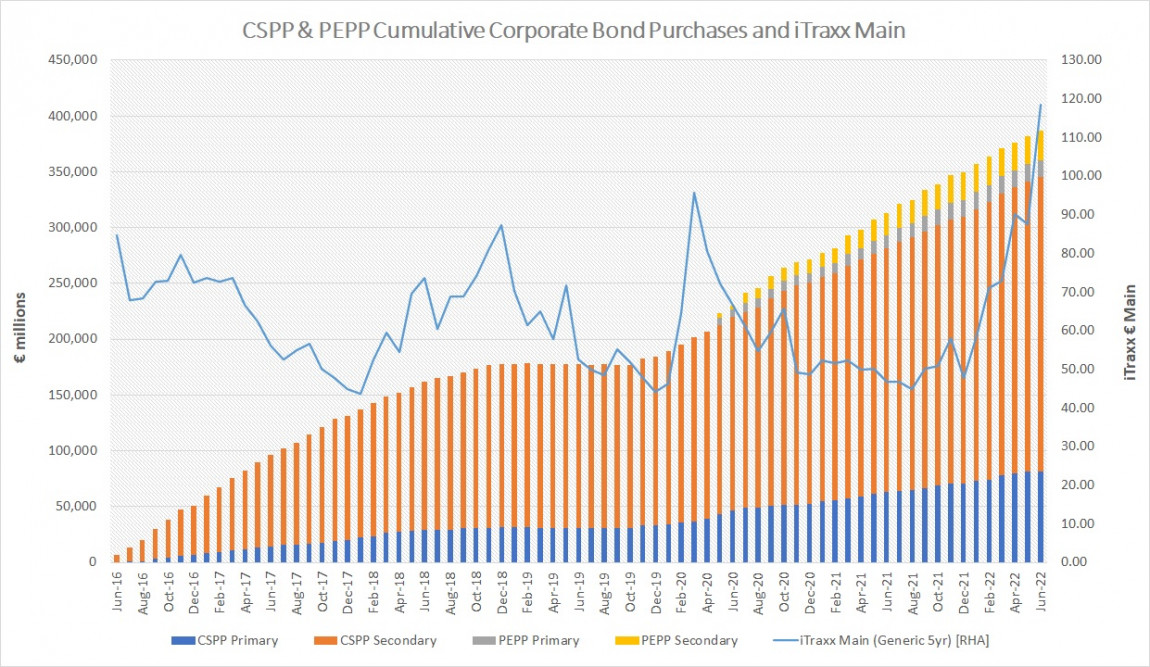

ECB cumulative corporate bond purchases as at end of June 2022 (book value)

Source: ICMA analysis using ECB and Bloomberg/Markit data

The pace of purchases under the CSPP slowed in Q2 of 2022, the final quarter of net purchases, with a monthly average of €4.8bn (vs a monthly average of €7.1bn in Q1, and a monthly average of €6.5bn since the CSPP resumed in November 2019). This takes total net cumulative purchases under the CSPP to €345.0bn (of which €81.7bn, or 24%, are primary market purchases, and €263.3bn, or 76%, are secondary). Including the €41.8bn purchases of corporate bonds under the PEPP (which ceased net purchases at the end of March 2022), this takes the total net cumulative purchases of corporate bonds under both programmes to €386.8bn.

Based on Bloomberg data, ICMA estimates a universe of CSPP eligible bonds at the end of June 2022 with a nominal value of €1,250bn. This suggests that 31% of all eligible bonds are being held under the purchase programmes. Based on the 70% upper limit for purchases of individual ISINs, this implies that purchases are at 44% of capacity, leaving an estimated available pool of around €875bn.

ECB provides details on how it aims to decarbonise its corporate bond holdings

19 September 2022

The European Central Bank (ECB) has published further details on how it aims gradually to decarbonise the corporate bond holdings in its monetary policy portfolios, on a path aligned with the goals of the Paris Agreement. One goal is to reduce the Eurosystem’s exposure to climate-related financial risk, following the Governing Council’s July 2022 decision to tilt the Eurosystem’s corporate bond purchases towards issuers with a better climate performance. Furthermore, these measures support the green transition of the economy in line with the EU’s climate neutrality objectives

ICMA briefing note on APP & PEPP

13 July 2022

Following the cessation of net purchases under the ECB’s Pandemic Emergency Purchase Programme (PEPP) from March 2022 and the cessation of net purchases under the ECB’s Asset Purchase Programme (APP) from June 2022, ICMA has published a short briefing note providing an overview of the two programmes. This includes the history of net monthly and cumulative purchases, a breakdown of current holdings, and the impact on both eurozone sovereign bond spreads and euro credit spreads.

ECB Publishes breakdown of PEPP purchases up until the end of November 2021

20 December 2021

The ECB has published its tenth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from October through November 2021. ICMA has consolidated the data along with that from the APP, into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of September 2021

8 October 2021

The ECB has published its ninth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from August through September 2021. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of July 2021

10 August 2021

The ECB has published its eighth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from June through July 2021. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of May 2021

7 June 2021

The ECB has published its seventh bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from April through May 2021. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of March 2021

8 April 2021

The ECB has published its sixth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from February through March 2021. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of January 2021

8 February 2021

The ECB has published its fifth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from December 2020 through end-of-January 2021. ICMA has consolidated the data into a short briefing note.

ECB announces extension of the PEPP

10 December 2020

Following its December meeting, the Governing Council of the European Central Bank (ECB) announced an extension of the Pandemic Emergency Purchase Programme (PEPP) by €500bn to a total of €1.85tn, with purchases continuing at least until March 2022.

ECB Publishes breakdown of PEPP purchases up until the end of November 2020

9 December 2020

The ECB has published its fourth bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from October through end-of-November 2020. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of September 2020

8 October 2020

The ECB has published its third bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from August through end-of-September 2020. ICMA has consolidated the data into a short briefing note.

ECB Publishes breakdown of PEPP purchases up until the end of July 2020

5 August 2020

The ECB has published its second bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from June through end-of-July 2020. ICMA has consolidated the data into a short briefing note.

ECB announces extension of the PEPP

4 June 2020

Following its June meeting, the Governing Council of the European Central Bank (ECB) announced an extension of the Pandemic Emergency Purchase Programme (PEPP) by €600bn to a total of €1.35tn, with purchases continuing at least until the end of 2021.

ECB Publishes breakdown of PEPP purchases up until the end of May 2020

2 June 2020

The ECB has published its first bi-monthly breakdown of holdings under its Pandemic Emergency Purchase Programme (PEPP), covering the period from March through end-of-May 2020. ICMA has consolidated the data into a short briefing note.

ECB takes steps to mitigate impact of possible rating downgrades on collateral availability

22 April 2020

The Governing Council of the European Central Bank (ECB) adopted temporary measures to mitigate the effect on collateral availability of possible rating downgrades resulting from the economic fallout from the coronavirus (COVID-19) pandemic. The decision complements the broader collateral easing package that was announced on 7 April 2020.

While only around 3% of collateral committed in the various ECB repo facilities constitute corporate debt, this measure could be more meaningful if and when this is extended to CSPP purchase. ICMA estimates that of the current eligible pool of investment grade corporate assets (roughly €850bn nominal value), around €300bn carries a BBB+ or BBB rating. This amounts to €210bn of potential purchases (based on a 70% issue limit) that could be at risk of being downgraded in the near future, or 35% of the overall eligible stock. Furthermore, while the measure does not in itself provide direct stimulus to the European High Yield market (it only applies to bonds carrying an investment grade rating as on 7 April, so effectively subsequent ‘fallen angels’), it nonetheless provides a degree of implicit support.

ECB publishes FAQ on CSPP and non-financial commercial paper

27 March 2020

ECB publishes pandemic emergency purchases programme (PEPP) Questions & Answers

26 March 2020

ECB announces €750 billion Pandemic Emergency Purchase Programme (PEPP)

18 March 2020

The Governing Council has announced the launch of a new temporary asset purchase programme of private and public sector securities to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the outbreak and escalating diffusion of the coronavirus, COVID-19. This new Pandemic Emergency Purchase Programme (PEPP) will have an overall envelope of €750 billion. Purchases will be conducted until the end of 2020 and will include all the asset categories eligible under the existing asset purchase programme (APP).

Furthermore, it will expand the range of eligible assets under the corporate sector purchase programme (CSPP) to non-financial commercial paper, making all commercial papers of sufficient credit quality eligible for purchase under CSPP.

ECB announces comprehensive package of monetary policy measures in response to Covid-19 risks

12 March 2020

At its meeting on 12 March 2020, the ECB’s Governing Council decided on a comprehensive package of monetary policy measures intended to anticipate potential downside risks resulting from the Covid-19 pandemic. These included:

- A temporary increase in the APP until the end of the year, adding additional net purchases of €120bn. The ECB emphasised a strong contribution from the private sector purchases programmes, suggesting a relative step-up in CSPP purchases.

- Additional longer-term refinancing operations (LTROs). These will be carried out through a fixed rate tender procedure with full allotment, with an interest rate that is equal to the average rate on the deposit facility.

- More favourable terms applied to all outstanding targeted longer-term refinancing operations (TLTROs) for the period of June 2020 to June 2021, intended to provide additional support through bank-lending to SMEs.

Furthermore, the ECB announced that banks will be allowed partially to use some of their non-Tier 1 capital buffers, as well as their liquidity coverage ratio, to provide capital relief for the banking sector to support the economy.

The ECB left interest rates unchanged.

European Parliament urges ECB to redesign CSPP to support sustainability objectives

February 2020

On February 12 2020, MEPs passed a resolution asking the European Central Bank to step up its green credentials and address growing financial technology challenges. The Parliament calls on the ECB to better integrate environmental, social and governance (ESG) principles into its policies and redesign its corporate sector purchase programme (CSPP) to better support environmentally sustainable initiatives. MEPs deplored that green bond issuance still accounts for only 1 % of the overall supply of euro-denominated bonds, while a majority (62.1 %) of ECB corporate bond purchases remain in sectors that are responsible for 58.5 % of euro area greenhouse gas emissions.

How ECB purchases of corporate bonds helped reduce firms’ borrowing costs

January 2020

New article by the ECB which argues that the programme has been successful. In particular, by increasing prices and reducing yields in the targeted bond market segment, the programme encouraged investors to shift their investments towards similar but somewhat riskier bonds. This reduced borrowing costs for many firms, including those whose bonds were not eligible for direct purchase by the ECB.

Temporary pause in purchases into year-end

December 2019

The Eurosystem will temporarily halt APP purchases (PSPP, CBPP3, CSPP and ABSPP) from 19 December to 31 December 2019, inclusive, in anticipation of significantly lower market liquidity towards the end of the year and in order to reduce possible market distortions. Purchases will resume on 2 January 2020.

Asset purchases to recommence November 2019

12 September 2019

As widely expected, the Governing Council of the European Central Bank announced a new round of monetary stimulus at its meeting of 12 September 2019. The easing package included a cut in the central bank deposit facility rate from -0.40% to -0.50%, a two-tier system for reserve remuneration (with a portion of banks’ excess reserves being subject to 0%), adjustments to modalities of the Targeted Long-Term Repo Operations (TLTRO III), and a restart of asset purchases. The changes to the deposit rate and tiering will apply from the start of the seventh reserve maintenance period on 30 October 2019. Asset purchases will resume on 1 November 2019.

The Asset Purchase Programme (APP) will target monthly net purchases of €20 billion and is expected to run “for as long as necessary”. The ECB has not specified splits between the various APP programmes and is likely to include both public assets, under the Public Sector Purchase Programme (PSPP) and private assets, under the Covered Bond Purchase Programme (CBPP3), Asset-Backed Securities Purchases Programme (ABSPP), and Corporate Sector Purchase Programme (CSPP). It may be that the ECB wishes to keep its options open, but commentators broadly expect purchases to be mostly under the revived PSPP. The Governing Council also announced that in line with an earlier adjustment to the PSPP, it would be possible under the CBPP, ASBPP, and CSPP to purchase bonds with yields below the deposit facility rate, effective immediately.

With respect to the CSPP, while the ECB has not specified a target for corporate bond purchases, the current expectation is for net monthly purchases in the region of €2-€2.5 billion. Feedback from ICMA members suggest concern over the impact of a new round of corporate bond purchases on secondary market liquidity.

Applying the same criteria for the previous CSPP, the estimated universe of eligible bonds for purchases is in the region of €760 billion nominal value. Given the ECB’s existing holdings of around €180 billion, and a cap on holdings of 70% of nominal outstanding of individual ISINs, this would suggest that a pool of just over €400 billion bonds is available. However, taking into account issues with low liquidity or concentrated holdings, the true investible pool is likely to be somewhat smaller.

In terms of reactions to the ECB’s announcement, credit spreads had largely discounted the resumption of the CSPP. As illustrated by the iTraxx Main 5-year index (see above chart), investment grade corporate bond spreads had been tightening since the start of the summer, and by the time of the ECB’s September meeting were nearing historic lows, and significantly tighter than at the cessation of the programme in December 2018.

ICMA will continue to monitor impacts of the CSPP2 on corporate bond market efficiency and liquidity, and through the SMPC will remain in close touch with both sell-side and buy-side members active the European corporate bond markets, as well as the ECB.

Asset purchases to end in December 2018

14 June 2018

Following its meeting on June 14 2018, the ECB’s Governing Council announced that its Asset Purchase Programme (APP) will reduce its purchases of €30bn per month to €15bn per month after September, and cease at the end of December, subject to future economic data. The ECB also updated its forward guidance on rates, stating that these would remain at their present levels at least through to summer of 2019, and potentially longer, depending on its inflation outlook. The ECB provided no update on APP reinvestments.

Bond markets have taken the announcement and subsequent press conference as relatively dovish. In response to the news 2yr German government bond yields fell 5bp and 10yr yields 6bp. Meanwhile, credit spreads tightened, with the 5yr iTraxx main moving 3bp lower and the 5yr iTraxx cross-over 8bp lower.

ECB article on the successful implementation of the CSPP

May 2018

The ECB has published an article in its May 2018 Economic Bulletin that discusses The Impact of the Corporate Sector Purchase Programme on Corporate Bond Markets and the Financing of Euro Area Non-Financial Corporations.

The report concludes:

- Since the announcement of the CSPP in March 2016, financing conditions for euro area NFCs have improved considerably. Much of the tightening of corporate bond spreads and increased issuance of corporate bonds can be directly attributed to the effects of the programme.

- Indirectly, the CSPP has also had positive knock-on effects on the wider financing environment for firms in the euro area. Financing conditions outside of corporate bond markets improved, and there are indications that the CSPP has freed up the balance sheet capacity of banks to lend to companies that are not eligible under the programme.

- While the programme appears to have contributed to a shift from bank to bond funding among eligible NFCs, this has not resulted in a decline in bank lending to the NFC sector as a whole.

- Evidence of adverse side effects on corporate financing and market functioning as a result of the CSPP is rather scarce. In particular, the smooth implementation of the programme, underpinned by the flexible pace of Eurosystem purchases and its adaptability to dynamics in the primary market, has safeguarded corporate bond market functioning and liquidity conditions.

- Overall, the findings back up the assessment of a successful implementation of the programme under changing market conditions without having a distortive market impact.

ECB announcement on the Asset Purchase Programme

October 2017

On 26 October 2017 the ECB’s Governing Council announced changes to its Asset Purchase Programme (APP). This was largely in line with consensus expectations of an extension of purchases, at a reduced rate, and with a shift in emphasis towards forward guidance. However, this is likely to have implications with respect to European corporate bond secondary market efficiency and liquidity.

The key changes to the APP are:

- The APP is to be extended by 9 months to September 2018.

- Rate of purchases to be reduced from €60bn to €30bn per month.

- Programme to remain ‘open ended’, giving the GC room to increase the rate of purchases or to extend beyond Sep 2018, if they feel it necessary

- Any rate rises will come ‘well after’ the programme ends (pointing well into 2019).

- If the APP continues as scheduled, the ECB will hold around €2.5tn of assets by its conclusion this time next year: around a third of the Euro areas public debt.

- No details were given with respect to the composition of the purchases, however additional information on the ECB website states: The Eurosystem anticipates that the purchase volumes under the three private sector purchase programmes (the ABSPP, the CBPP3 and the CSPP) will remain sizeable. This would suggest a relative shift from public to private assets, and, most likely, the emphasis being on the Corporate Sector Purchase Programme.

- The ECB will also begin publishing monthly redemption amounts for the 4 APP components in anticipation of an increase in redemptions in 2018 (providing more transparency around its reinvestment schedule).

The continuation of the APP will potentially provide an even more complicated background as MiFID II/R is implemented in the European bond markets from January 2018. Accordingly, the intersection of monetary policy and market regulation as it impacts the European fixed income markets, in particular the corporate bond markets, will remain a high priority of the ICMA Secondary Market Practices Committee (SMPC).

29 September 2017

ECOFIN publishes 3 new papers assessing the CSPP

21 June 2017

The ECB publishes an update on the CSPP implementation and impact in its Economic Bulletin

3 November 2016

The ECB joined the regular meeting of the SMPC to discuss the ongoing implementation and impacts of its Corporate Sector Purchase Programme. A note of the meeting can be found here.

3 August 2016

ECB publishes update on the implementation of the CSPP in its Economic Bulletin

3 June 2016

Following yesterday’s meeting of the ECB’s Governing Council, further details of the CSPP have been made available (see press release here).

Of key note among the additional details are:

- Purchases to start on June 8

- A list of bonds purchased will be published weekly by the relevant NCBs (although only ISINs, not nominal holdings)

- Purchases will be made available under the respective NCB securities lending/repo arrangements from June 18

- Counterparties to CSPP purchases can communicate that the Eurosystem has been buying in the corporate space, the maturity bucket and the sector (e.g. utilities), but not the exact amounts, the issuers of the bonds purchased, the securities involved, or the Eurosystem member involved.

- Further clarity is provided related to non-eligible financial issues: essentially purchases will exclude bonds issued by an entity, or its subsidiary, that is supervised under the Single Supervisory Mechanism, as well as issuers with a parent company that is subject to banking supervision outside of the euro area.

The updated Q&A is provided here.

29 April 2016

ICMA publishes further thoughts on the ECB’s CSPP following the announcement of details of the Programme on 21 April

21 April 2016

ECB announces details of the corporate sector purchase programme (CSPP)

21 April 2016

The announcement by the ECB on March 10 to extend its Asset Purchases Programme to include investment grade non-bank corporate bonds took the market by complete surprise. This briefing note is an attempt to outline the various considerations that the ECB may need to review as it puts together the final details of its soon to be launched Corporate Sector Purchase Programme, as well as the possible implications for market liquidity and investor and issuer behaviour.

To view the briefing note, click here.

15 March 2016

ICMA has today published a briefing note on how ICMA intends to respond to the Corporate Sector Purchase Programme, and to work with its members, across committees and the regions, to help ensure that the CSPP achieves its objective without compromising resilient and well-functioning European corporate bond markets.

To view the briefing note, click here.

Contact:

Andy Hill

Managing Director, Head of Market Practice; Secretary to the Secondary Market Practices Committee and also responsible for overseeing repo policy; Member of the ICMA Executive Committee

Direct line: +44 20 7213 0335

27 July 2020

Bank of England publishes Q2 2020 Quarterly Report for transactions under the Asset Purchase Facility (APF)

During 2020 Q2 the APF made £167.8 billion of gilt purchases and £6.1 billion of corporate bond purchases.

1 May 2020

Bank of England publishes Market Notice on Additional Corporate Bond Purchases under the APF

Market Notice describes the operation of the Bank of England’s Corporate Bond Purchase Scheme, consolidating existing provisions and replacing previous notices. The Notice outlines eligible securities, eligible counterparties, and operating parameters.

2 April 2020

19 March 2020

The Bank of England has published a Staff Working Paper on the impact of the Bank of England’s Corporate Bond Purchase Scheme on yield spreads.

The CBPS, announced in August 2016, targeted purchases of up to £10bn of investment grade, sterling corporate bonds issued by firms making a ‘material’ contribution to the UK economy.

The analysis finds that compared to sterling investment-grade corporate bonds that are non-CBPS eligible, CBPS eligible bonds tightened by about 2-5bp after the announcement of the scheme. However, this is likely to underestimate the effect of purchases since it does not account for portfolio rebalancing. Comparing yield spreads of eligible sterling bonds with EUR and USD bonds issued by the same firms, shows that sterling assets tightened by 13-14bp.

The paper suggests that the effect of the scheme on yield spreads may come from two channels. First, the presence of a large market participant increases market liquidity, i.e. reduces the illiquidity premium. Investors readjust their portfolio of sterling corporate bonds: selling eligible assets, and buying ineligible ones. Second, a lower level of yields in the secondary market reduce companies’ funding costs when they decide to issue debt in the future, which can improve their profitability and thereby lower their credit risk premia. This effect reinforces the reduction in yield spreads.

10 November 2016

The Bank of England joined an ad hoc meeting of the SMPC to discuss the ongoing implementation and impacts of its Corporate Bond Purchase Scheme. A note of the meeting can be found here.

Bank of England publishes Press Notice on the eligibility and sectors under the Corporate Bond Purchase Scheme

On 12 September 2016, the Bank of England published a press notice providing further details on the eligibility and sectors under the Corporate Bond Purchase Scheme. The notice can be downloaded here.

This expands on the Market Notice published on 4 August 2016, and available here.

Contact:

Andy Hill

Deputy Head, Market Practice and Regulatory Policy; secretary to the Secondary Market Practices Committee and also responsible for overseeing repo policy.

Direct line: +44 20 7213 0335