CFC — The Preferred Choice for Corporate Financial Practitioners

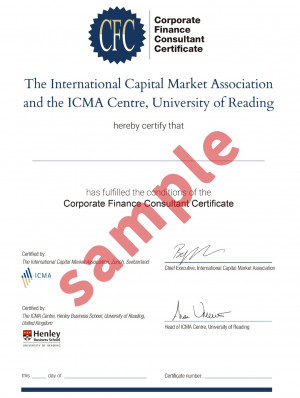

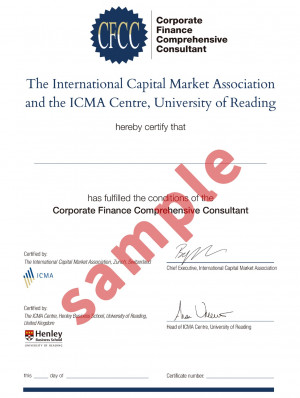

Corporate finance consultants are practitioners in commercial banks, securities companies, insurance companies, trust companies, asset management companies and other financial institutions who offer financial services such as financial planning, investment management, capital structure management, financial risk management and financial consultation to enterprises. The Corporate Finance Consultants (CFC) education and certification system includes the following three tiers: Corporate Finance Comprehensive Consultant (CFCC), Corporate Finance Consultant (CFC) and Corporate Finance Specialist (CFS). The certificates are issued by the International Capital Market Association (ICMA) and the University of Reading.

In China, many institutions have become members of ICMA, including China Central Depository & Clearing Co., Ltd. (CCDC), Shanghai Clearing House, Shanghai Stock Exchange, Shenzhen Stock Exchange, Asian Infrastructure Investment Bank (AIIB), New Development Bank, Industrial and Commercial Bank of China, Bank of China, and China Construction Bank etc.

The Corporate Finance Consultants (CFC) program forms part of ICMA’s comprehensive financial education curriculum for practitioners as part of its efforts to establish and promote international standards. It primarily benefits practitioners from financial institutions such as banks, securities, insurance, and relevant consulting service providers involved in corporate finance and investment activities. It also serves internal management personnel and individuals engaged in financial management, fund management, financial markets, and other related fields. The CFC program aims to enhance their knowledge and skills in finance and investment. Potential employers for CFC certificate holders include commercial banks, securities, companies, fund management companies, accounting firms, governmental authorities, multinational corporations, and publicly listed companies. Amidst the global interest rate marketization, financial liberalization, and market internationalization, comprehensive corporate finance has seen rapid development. Providing integrated financial services based on the money markets and capital markets, including comprehensive financial services such as credit, bonds, equities, agency, and insurance for technology-innovative enterprises throughout their lifecycle, has become a distinctive business area for advanced financial institutions. Offering diversified, multi-regional, and multi-currency integrated financial services to global clients will effectively enhance the commercial competitiveness of international banks and other financial institutions.

As an international self-regulatory organization, ICMA has been striving to integrate the cutting-edge knowledge of corporate finance with China's economic and financial practices. It has assisted Chinese financial institutions and industry organizations in aligning with international capital markets' standards and systems, particularly in light of its growing membership in the country which today includes China Central Depository & Clearing Co., Ltd. (CCDC), Shanghai Clearing House, Shanghai Stock Exchange, Shenzhen Stock Exchange, Asian Infrastructure Investment Bank (AIIB), New Development Bank, Industrial and Commercial Bank of China, Bank of China, and China Construction Bank, among others. In 2009, with support from the China-UK Economic and Financial Dialogue and the Special Fund of the State Administration of Foreign Experts Affairs, ICMA was introduced to China through the Office of Leading Group for Introducing Foreign Intelligence, National Development and Reform Commission (NDRC). Since 2012, ICMA has been actively supporting the drafting of corporate finance industry standards in China. In December 2016, the People's Bank of China issued and implemented the "Corporate Finance Consultant (JRT 0139-2016)" financial industry standard (Issued by PBC[2016] No. 325), which standardized the business processes and professional competencies of corporate finance consultants. In March 2021, the Ministry of Human Resources and Social Security of China issued the "Notice on the Release of Occupational Information for Integrated Circuit Engineering Technicians, etc." (Issued by MHRSS [2021] No. 17), incorporating corporate finance consultants into the "Occupational Classification of the People's Republic of China," defining them as practitioners working for banks, securities, insurance, trusts, third-party wealth management, and related financial service institutions, engaged in providing comprehensive consulting services, including financial planning, investment and finance planning, capital structure management, financial risk prevention and control, and financial information consulting, to institutions operating in real economy e.g. enterprises . It also includes practitioners engaged in investment and finance management and financial management within enterprises. As the CFC program receives recognition and support from Chinese government agencies such as the People's Bank of China and the Ministry of Human Resources and Social Security, its influence continues to expand. Many Chinese major financial institutions, including Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), Bank of China (BOC), China Construction Bank (CCB), Bank of Communications (BOCOM), Postal Savings Bank of China, and others, have organized CFC training and certification in different forms, resulting in a large number of practitioners obtaining CFC certificates. By the end of 2022, the cumulative number of trained students has exceeded 20,000.

As developing countries transition from high-speed growth to high-quality development, further financial market reforms, such as interest rates and exchange rates liberalization, are inevitable. In the future, regardless of the size or position in the industrial chain, enterprises will be directly or indirectly affected by financial market fluctuations. Therefore, the development of the real economy is closely related to the support from financial institutions. The diversified, refined, and personalized needs of corporate finance require the support of professional corporate finance talents. Whether they are financial practitioners, graduates in finance and economics, or corporate financial managers facing new career requirements due to artificial intelligence and financial technology development, they all need to systematically learn multi-layered capital market-oriented corporate finance knowledge. In the future, Corporate Finance Consultants (CFCs) certificate holders, as comprehensive practitioners who understand both enterprises and finance and can connect with multi-layered capital markets, will be in high demand and have promising prospects.

Click here to see lists of the CFC certificate holders.

Visit our official website http://www.cfcedu.org.cn/ for more details.